life insurance

How much life insurance do you need?

Life insurance is there to help your loved ones with financial needs if you are not there anymore. Consider your mortgage and other debts, how much income would need to be replaced, money to cover a funeral, and college for the kids. Add those up, and you will have a promising idea of how much insurance you will need.

There are two main categories of life insurance:

Term life insurance is the simplest and least expensive option. It covers you for a set period of time. You might consider term life insurance when you have a family that depends on your financial support or while you have a mortgage. For example, you may want a term life policy that lasts until your children are out of school. Today’s term policies can come with living benefits. Yes, term with living benefits!

Permanent life insurance provides coverage for your entire life as long as you keep up the payments. Because of the length of coverage, it costs more than term life insurance. These policies offer features like living benefits, safe growth by use of indexes out of the market, and the ability to take out loans tax-free to pay for life events like college, a new home or retirement income for life.

How much will it cost?

Insurance companies consider things like your age, health, job, and tobacco and alcohol use when setting prices. It will cost more to purchase life insurance as you get older and if you have health problems. Some companies may require a medical exam before selling you a life insurance policy.

Who will benefit?

You can leave money to a spouse, children, other family member, or friend. This is known as the policy’s beneficiary. You can also name an institution as your beneficiary, such as a business or charity. And you can choose more than one beneficiary and specify how the money will be divided.

We've Got You Covered

Our services can help you plan for the future and protect your family. Click below to schedule a free no obligation consultation with Retirewell Solutions today.

Why consider Retirewell Solutions for your life insurance needs?

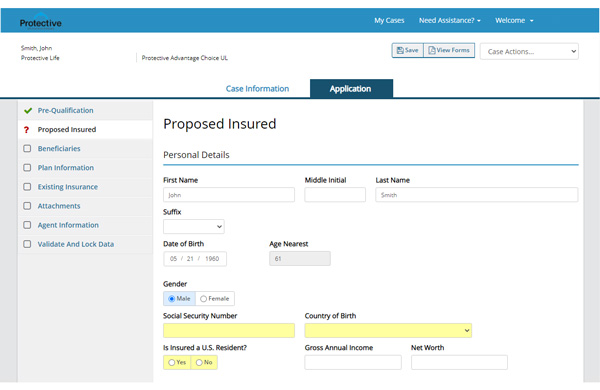

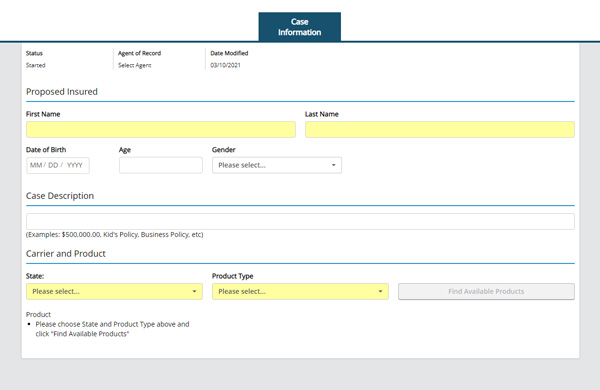

Selection, lowest policy rates and unbiased counsel. We utilize industry-leading software application technology to shop the top-rated carriers We then present you with a side-by-side, easy to compare spread sheet of the top five to six carriers that offer you the lowest policy rates with the most benefits – like term with living benefits.